As outsourcing becomes a cheaper and more effective means for businesses to delegate their functions, more and more crucial roles are being filled by outsourced talent. One recent trend involves engaging outsourced chief investment officers (OCIO).

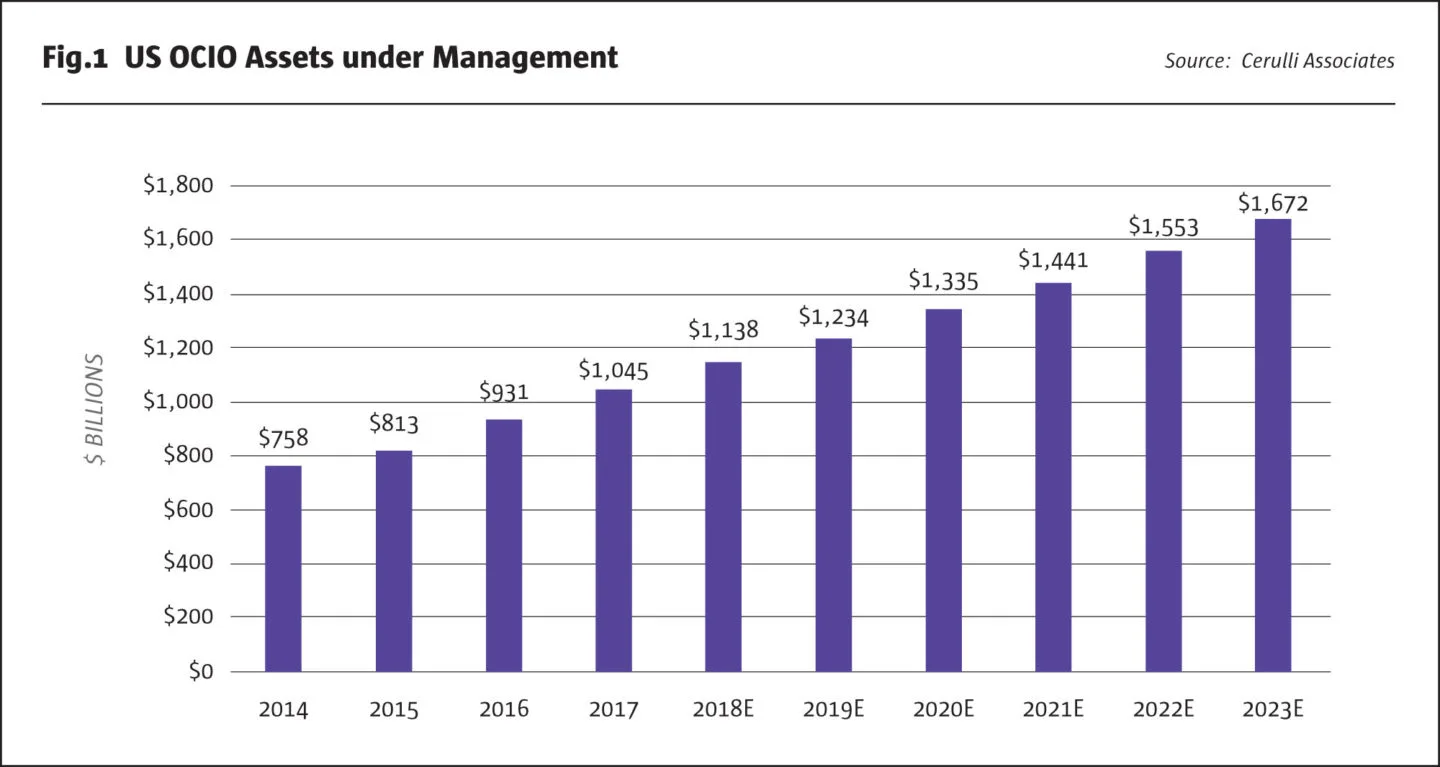

In 2021, the OCIO global assets under advisement were valued at $2.46 trillion and is expected to grow at a rate of 69%, reaching $4.15 trillion by 2026. With this, many companies are jumping on the bandwagon to take advantage of the booming market and leverage institutional investors.

What Is an Outsourced CIO?

An outsourced CIO is a third-party chief investment officer or investment committee to whom a company delegates its investment programs. Because of the provider’s investment management expertise, companies use them to help with strategic asset allocation, manage risks, and monitor performance.

These investment advisors typically work alongside outsourced CFOs to make the best investment decisions supporting the organization’s financial health. Outsourced CIOs may also perform administrative tasks on top of investment management services. This helps free up your time for more profit-growing aspects while being confident that fiduciary responsibilities concerning your investments are met, even under market volatility.

Outsourced CIOs and their dedicated team can provide two levels of services, depending on your company’s needs. These are:

- Vertical assistance: The outsourced CIO provides services for a particular asset class, such as private markets or risk and FX management.

- Horizontal assistance: The outsourced CIO assumes the tasks in an entire institutional portfolio, including a range of risks and controls, investment strategy, and reporting on market environments.

What Are the Services of an Outsourced CIO?

An outsourced CIO mainly absorbs an organization's investment functions and handles all related tasks with their strategic goals in mind. Specifically, these include:

Investment strategy development

Outsourced CIOs deliver strategic advice by working with their organizations and clients to develop an investment strategy based on their unique goals, risk tolerance, and time horizon.

In the plan, they also review investment options to determine asset allocation and help establish performance benchmarks to continue tracking and monitoring the investments made by the company.

At a time when investment platforms are becoming more complex, regulatory requirements are getting stricter, and it’s becoming harder to generate the required returns, outsourced CIOs can provide their experience and expertise to find the best approach against investment challenges.

Investment management

An outsourced CIO’s job is to identify new and smart investment models for their client organizations. To that end, they work with investment consultants and professionals, such as asset managers and research analysts, to pinpoint and assess new areas worthy of the company’s investment.

They assume full responsibility for a company’s investment performance, risk management, and ongoing oversight under different financial markets to keep an eye on market cycles and market opportunities.

Risk management

Every investment comes with risks, and it’s an outsourced CIO’s job to develop portfolio management strategies that will keep the company’s financial health in good condition. To do this, they may take on strategic decisions like diversification, hedging, and monitoring risk.

Performance monitoring and reporting

An outsourced CIO assumes the client portfolios, though the institutional clients still maintain fiduciary responsibility and a good level of control over their financial situation and long-term targets.

As such, an outsourced CIO must be able to provide a comprehensive client experience, regularly presenting attribution analysis and risk metrics while giving recommendations for adjusting the investment strategy based on market conditions.

Governance and oversight

In hiring an outsourced CIO, a company entrusts its investment strategies to the provider’s broad range of knowledge and deep experience. Therefore, the full-time investment adviser or firm acting as OCIO must ensure that they make the best investment decisions redounded to the company’s best interest and benefit. Every action they take should follow the developed investment strategy, with clear communication to the client, such as a quarterly meeting to ensure investment styles are synced up.

Qualified investors are also expected to develop investment policies and procedures for meeting client objectives and review investment-related contracts and agreements, ensuring the asset owner’s rights are protected throughout the venture.

Why Should Companies Outsource Their CIO?

Companies are beginning to outsource and delegate their investment functions to OCIOs instead of hiring a professional to work with them in-house. This is owing to the various benefits that outsourcing this role can yield.

Investment expertise

Outsourcing gives companies access to suitable and skilled talent that may be hard to find in their locality. By looking to third-party providers, they can widen their scope and tap into qualified investors who are knowledgeable about industry practices and can take care of growth portfolios.

Backed by this expertise, companies can be confident in a dedicated CIO’s ability to make intelligent investment decisions that will pave the way for the organization’s financial growth.

Lower costs

Hiring, onboarding, and maintaining an in-house investment team can be expensive. According to a study by the Society for Human Resource Management, the recruitment process will cost companies an average of $4,129 and takes an average of 42 days per employee, not including salaries and benefits.

Outsourcing CIOs eliminates the need to go through the lengthy and time-consuming recruitment process, coincidentally eliminating the costs involved. This is especially helpful for smaller companies that do not have the resources and capacity to support a dedicated investment team in-house.

Besides savings from recruitment processes, companies also reduce operational risks by working with large CIO providers with long experience and good relationships with sub-managers. With a wealth of assets under their management, they can negotiate more competitive rates and aggregate their buying power to make the process more efficient and successful for their clients.

There are also outsourced CIOs who can offer transition management services, helping companies reduce costs and risks by curating a well-planned strategy to consolidate investment transactions.

Flexibility

Because outsourcing does not require a company to support talent in-house, they can benefit from more flexible arrangements and engagements with their outsourced CIO provider. The latter will provide its services as needed, which gives the company enough wiggle room to scale up or down whenever required.

This can be especially valuable for companies always looking to expand to new markets or those with fluctuating investment needs.

Risk management

Making intelligent and healthy investments is much more complex than it sounds. Many factors come into play in determining whether or not an investment opportunity is worthwhile. Outsourced CIOs, backed by their expertise and investment market knowledge, can help companies better manage their risks and make informed investment decisions.

They do this through objective analysis and oversight of investment decisions with reduced bias and conflict of interest.

What To Look For in an Outsourced CIO Provider?

If you’re ready to make more profitable investment decisions for your company, you can start looking for an outsourced CIO provider. But to find the best one for your business, make sure that you take the following into account:

Experience and expertise

Identifying the best investment opportunities for your business cannot be learned overnight. It takes years of experience and knowledge, and skill-building. You should look for an outsourced CIO with a strong track record and a deep understanding of asset classes and investment strategies.

You should also find someone with experience in your industry so they know how companies like yours work and can spot investment opportunities that will benefit you and your market.

Investment process and philosophy

Next, look at how the outsourced CIO provider works. What are their plan sponsor methods and asset allocation policy? What is their philosophy to reduce enterprise risks? What does their work ethic look like to meet client expectations? When you've gathered information about customized solutions and additional services, make sure that they align with your company’s future performance goals, such as rate of return, business model, and key investment themes.

Customization

While identifying investment opportunities and deciding on investment decisions follows some industry best practices, it’s also essential that you find an outsourced CIO that can cater to your unique needs. No company is the same, and similar can be said about their investment goals and risk tolerance.

Ensure that your outsourced CIO provider can provide custom investment solutions tailored to your company's goals and objectives. They should be flexible enough to adjust their use of tools, align their investment strategies to each client’s specific needs, and emphasize providing services that work for them.

Some companies may delegate only a handful of investment functions, such as risk management or investment management. Others may want the complete package and the most holistic approach. Regardless, the outsourced CIO provider must be able to adjust their strategies to fit the requirements of their clients.

Risk management

Investing is a tricky venture. It’s difficult to pinpoint how the investment will affect your company – whether it will help you scale or cause your downfall. Because of that, you must have stringent risk management protocols to protect your investment and financial health.

Your outsourced CIO provider should be able to develop a risk management strategy that will keep your assets secure and manage risks while achieving your investment objectives.

Performance reporting

Your company and your finances are put on the frontlines here. So it’s imperative that you are kept in the loop at all times. Delegating your investment functions does not mean surrendering all control to your outsourced DIO.

Instead, part of their services should provide you with comprehensive and transparent reporting on each investment venture's investment portfolio performance, fees, and other expenses.

Culture and values

Outsourced CIOs will need to coordinate with your company a lot – and having the same culture, values, and work ethics will help facilitate a healthy relationship that ultimately leads to success.

Ensure your chosen outsourced CIO provider aligns with your company’s cutler and values. At the very least, you should find someone committed to transparency, integrity, and accountability.

Closing

Outsourcing your investment functions to an OCIO opens your business to investment opportunities that will catapult you to success. With their investment expertise and risk management capabilities coming at a lower cost and increased flexibility, it’s well worth your time and resources to hire an outsourced CIO for your company.

But before you do, define your needs and find the best CIOs for your unique needs and goals. Near can help you source top-quality outsourced CIOs from Latin America, guaranteeing experience, expertise, and investment knowledge. Start interviewing candidates for free today.

.png)

%20(1).png)

%20(1).png)